Prices of oil The effect on Nevada businesses is real, not just a thought. You can feel it in the higher costs of fuel and delivery and lower profit margins. When oil prices change quickly, they affect almost every part of Nevada’s business, from daily costs to long-term plans. Fuel prices in Nevada are important for many industries, so when they go up and down, your budget often does too.

Why Oil Prices Are Important In Nevada

Movement is a big part of Nevada’s economy. Trucks bring things into and out of the state. People come to see the sights by car and plane. People who work travel a long way. All of this work depends on fuel.

You can see when oil prices go up:

• Higher shipping and local delivery costs for fuel;

• Higher supplier bills that include built-in transportation costs;

• Pressure to raise prices or accept lower profit margins;

The opposite can happen when prices go up. Fuel costs ease, deliveries get cheaper, and some businesses have more room to breathe. The problem is that you don’t often get long periods of stability. Volatility is a risk that business owners must deal with.

Costs of fuel and transportation

Oil price changes affect any Nevada business that needs cars right away. This includes freight companies, local delivery services, contractors, trades, and service businesses that send people on the road.

The price of oil going up can:

• Raise the cost of delivery per mile

• Make it harder to keep up with same-day or free delivery offers

• Make it necessary to change routes to save on fuel

• Lower the profit on fixed-price contracts that didn’t include fuel adjustments

Even companies that don’t own fleets still need transportation. When fuel prices go up in Nevada, vendors raise their own prices, and those price increases go all the way up the supply chain.

Costs of doing business in Nevada and oil

The price of oil has an effect on more than just fuel. Many costs are hidden in your business. Heavy machinery is used in mining, construction, manufacturing, and logistics. Some places use backup generators or heating that runs on fuel.

When the price of oil goes up, you can see:

• Higher costs for running heavy machinery and equipment

• Higher costs for materials that take a lot of energy to make

• Pressure to cut other costs to keep margins safe

• Delays in expansion because projections become less certain

Because of this, people often say that the effect of oil prices on Nevada businesses is indirect but strong. You may never buy a barrel of oil, but its price still affects your rent, supplies, and service contracts.

Money coming in and going out, hiring, and investing

Owners are less sure about the future when energy prices are unstable. You are less likely to make big decisions when you can’t guess how much fuel will cost next quarter in NV.

That can make:

• Hiring staff more slowly or cutting their hours

• Putting off upgrades to equipment or renovations to stores

• Ordering inventory carefully to avoid getting stuck with expensive stock

• Less cash flow because more money is tied up in costs that change

Stable or falling oil prices, on the other hand, can free up money for hiring, marketing, and growth projects. Short-lived low prices are often not as valuable as predictability.

What Nevada Companies Do

A lot of businesses in Nevada don’t just deal with oil price shocks. They change. This can make them stronger and work better over time.

People often say:

• Buying vehicles and equipment that use less fuel

• Making better plans for routes and delivery times

• Adding fuel clauses to contracts

• Looking into renewable options when possible, like solar power for facilities

• Sharing rides with partners to fill trucks and cut down on empty miles

These steps make the model more stable, even when the market is volatile, and lower the risk of volatility.

Long-Term Planning and Energy Diversification

Energy diversification is important from a broader perspective. Every time the price of oil goes up, it hurts Nevada more if it only uses traditional fuels. When the state backs a mix of sources, like Clean Energy NV, the whole system is less likely to break down.

This could mean the following for businesses:

• Facilities will have more stable long-term power contracts.

• There will be new opportunities in sectors related to a hybrid energy model.

• Global oil markets will be less vulnerable to sudden shocks.

This is where state-level planning and policy come into play. Businesses can make better long-term decisions when they know where energy prices are going in the future, instead of reacting to every short-term price change.

FAQs About Oil Prices And Nevada Businesses

Q1. Which Nevada businesses feel oil price changes the most?

Companies that rely heavily on transportation feel it first. These include trucking and logistics firms, construction companies, field service providers, tourism and hospitality businesses, and retail operations that move large volumes of goods.

Q2. Do small businesses suffer more than large corporations?

Often, yes. Large companies may have fuel contracts, bigger cash reserves, or more power to negotiate with suppliers. Small businesses usually have less room in their budget, so every increase in fuel or material cost hits them harder and faster.

Q3. Can Nevada reduce its exposure to oil price swings?

Nevada cannot control global oil markets, but it can improve efficiency, invest in better transit and freight infrastructure, support alternative fuel fleets where practical, and streamline regulations that add unnecessary costs to transportation and energy projects.

Q4. How does this affect workers and families?

When businesses pay more for fuel and materials, they may cut hours, slow hiring, or hold wages steady despite higher living costs. That puts pressure on household budgets. It can also lead to fewer local job opportunities, especially in rural areas that already face limited options.

Q5. What role can leaders like Paul play?

State leaders can listen to business owners, workers, and local communities, then craft policies that lower operating costs, support efficient business operations Nevada-wide, and improve long-term energy resilience. The aim is a stronger economy where the Nevada business impact of oil prices is less painful for everyone.

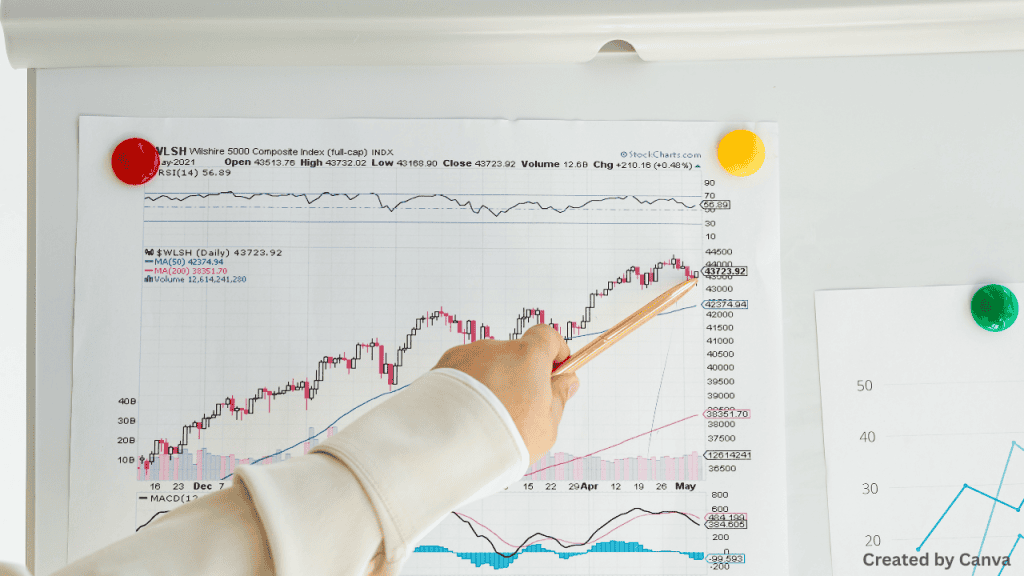

Images are by Canva.com

Featured Image